In the journey towards owning your dream home, navigating through the intricacies of loan repayment options is pivotal. Among the discussions surrounding financing, two prevalent methods stand out: Pre EMI and Full EMI. Let's break down these terms, exploring their nuances, benefits, tax implications, and how to make the optimal choice tailored to your financial scenario.

Understanding Pre EMI and Full EMI Options

What is Pre EMI?

Pre EMI, also known as Pre-Equated Monthly Installment, entails paying only the interest component on the disbursed loan amount until the entire loan sum is received. Initially, this results in lower monthly payments, gradually increasing as the principal is disbursed.

What is Full EMI?

In contrast, Full EMI involves repaying both the principal and interest components from the onset of the loan tenure. With Full EMI, monthly payments remain steady throughout the loan duration, provided the interest rate remains constant.

Differentiating Pre EMI and Full EMI

The core disparity lies in their repayment structures: Pre EMI offers lower initial payments that incrementally rise, while Full EMI maintains consistent monthly payments.

Advantages of Pre EMI

1. Reduced Initial Burden: Pre EMI mitigates the financial strain during the initial loan stages.

2. Enhanced Cash Flow Management: Ideal for those with fluctuating incomes, it facilitates better cash flow management.

Advantages of Full EMI

1. Expedited Principal Repayment: Full EMI initiates simultaneous repayment of principal and interest, leading to a quicker reduction in loan principal.

2. Predictable Payments: With fixed monthly payments, Full EMI offers predictability, simplifying budgeting.

Choosing the Optimal Option

1. Pre-EMI is Suited for: Individuals with limited initial cash flows or anticipating future income growth, benefiting from lower initial payments.

2. Full EMI is Ideal for: Individuals with stable incomes seeking predictable payments and aiming for accelerated loan repayment.

Tax Benefits

Both Pre EMI and Full EMI options provide tax benefits under Section 24 and Section 80C of the Income Tax Act. However, the magnitude and timing of deductions may vary based on the chosen repayment option and repayment stage.

Deciphering Pre EMI vs. Full EMI: Which is Superior?

The selection between Pre EMI and Full EMI hinges on your financial circumstances, cash flow projections, and personal preferences. There's no one-size-fits-all solution; the optimal choice aligns with your unique goals and situation.

Illustration

Let’s take an example to understand this better:

Let’s assume you are buying a property. Below are all the calculations for that:

Property amount: ₹45,00,000

Down payment: ₹9,00,000

Loan Amount: ₹36,00,000

Interest Rate: 8.5%

Tenure: 20 years

Full EMI Calculation: Monthly EMI: ₹31,242 Total Interest Payable in 20 years: ₹38,97,993

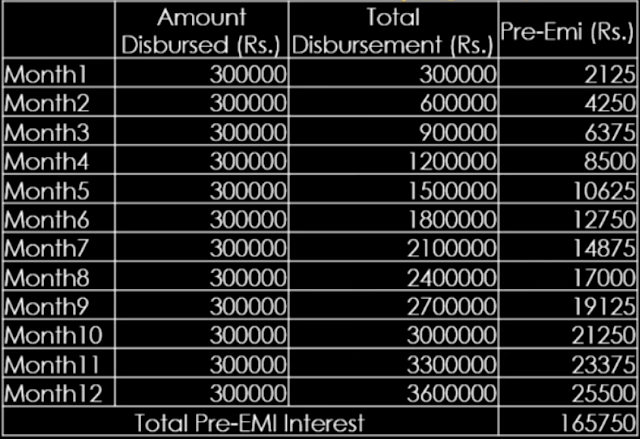

Pre EMI Calculation:

As we can see in the EMI schedule above, you will end up paying ₹1,65,750 if you choose the Pre EMI option, and your tenure will also increase by 1 year, i.e., 21 years.

FAQ Corner

1. What is an EMI?

An EMI, or Equated Monthly Instalment, is a fixed amount paid by a borrower to a lender at a specified date each calendar month. It typically comprises both principal and interest components of a loan, such as a home loan or a car loan.

2. What are the drawbacks of Pre EMI?

While Pre EMI offers lower initial payments, it may result in higher overall interest payments compared to Full EMI. Additionally, since the principal repayment begins later, the total interest paid over the loan tenure might be higher.

3. Can Pre EMI be switched to Full EMI?

Yes, depending on the terms and conditions of the loan agreement, it's possible to switch from Pre EMI to Full EMI. However, this may be subject to certain conditions and possibly additional fees or charges.

4. Will the EMI be lower with Pre-EMI or Full EMI?

Initially, Pre EMI may offer lower EMIs since it involves paying only the interest component. However, over the entire loan tenure, Full EMI may result in lower overall interest payments due to earlier commencement of principal repayment.

5. When do repayments commence with Pre EMI and Full EMI?

Repayments start immediately with Full EMI, with both principal and interest payments beginning from the first month. In contrast, with Pre EMI, payments start once the loan amount is fully disbursed, with initial payments covering only the interest component.

6. Are there disparities in tax deductions between Full EMI and Pre EMI?

Both Full EMI and Pre EMI options offer tax benefits under Section 24 and Section 80C of the Income Tax Act. However, the timing and amount of deductions may vary based on the repayment option chosen and the stage of repayment.

7. If planning to sell the property within a few years, which option is preferable?

Full EMI may be preferable if planning to sell the property within a few years, as it accelerates principal repayment. This can potentially reduce the outstanding loan amount at the time of sale, providing more flexibility and financial benefit.